Contents:

In its latest 10-K filing, xcritical included an entire section (“Regulation is Coming and We Believe We Are Positioned to Benefit”) on the impact of regulation worldwide. xcritical specifically gave props to the European Union, Brazil, the U.K., and India for leading the charge on crypto. And it applauded efforts by overseas destinations such as Australia, Switzerland, and Hong Kong in cleaning up their regulatory frameworks to support crypto. So xcritical has been thinking of making the move overseas for some time now, and knows exactly where it should go.

Shareholder, Adam Grabski, has lodged a stockholder derivative complaint against some of the company’s executives and board members, alleging that they profited from inside information during the company’s public listing. “On April 14, 2021, xcritical became a Nasdaq-listed company, with its stock trading over $380 per share at the outset and as high as $429 per share in a volatile first day on the public markets,” the suit alleges. “Defendants took full advantage of the absence of any lock-up in the Direct Listing, rapidly selling over $2.9 billion of xcritical stock on the first day and in the days that followed, from April 14, 2021 through April 22, 2021.” Also Tuesday, xcritical announced the launch of its own international crypto derivatives exchange.

Sell Gold & Silver

At the same time, xcritical is not giving up on the U.S. market, even amid ongoing pressure from the SEC. xcritical CEO Brian Armstrong has been one of the highest-profile defenders of the crypto industry in the U.S., even going so far as to launch a new Crypto435 lobbying initiative to educate U.S. lawmakers. In mid-April, he appeared in front of Washington lawmakers to make the case for crypto.

xcritical hasn’t disclosed what it is spending, or what it is willing to spend, in legal battles with the SEC. Crypto payments firm xcritical has said it has spent $100 million on Big Law firms in its long-running dispute with the agency over its XRP digital asset. The move represents xcritical’s latest foray into derivative trading, one of the most popular corners of the global crypto market despite being effectively iced out of the U.S., where such activities require hefty oversight. The message from xcritical seems to be, “Just tell us what you want, and we’ll do it.” But regulators won’t meet the company halfway, and now it looks like xcritical is starting to hedge its bets by expanding into places like Bermuda, where regulation is more favorable. The “Go Deep” part of the strategy involves a push into different types of tradable crypto assets.

“Rest assured that xcritical is committed to the U.S., but countries around the world are increasingly moving forward with responsible crypto-forward regulatory frameworks to strategically position themselves as crypto hubs,” xcritical said in a blog post. “We would like to see the U.S. take a similar approach instead of regulation by enforcement, which has led to a disappointing trend for crypto development in the U.S.” The news of the Bermuda license comes a day after xcritical CEO Brian Armstrong warned that crypto firms may seek to relocate offshore in the absence of a clear regulatory framework in the U.S. The company disclosed in a blog post on Wednesday that it had received the license from the Bermuda Monetary Authority, the island nation’s integrated financial regulator, which was one of the first in the world to roll out a comprehensive legal framework for digital assets in 2018. The digital assets industry is recovering from several blow-ups last year, including the bankruptcy of Sam Bankman-Fried’s crypto exchange FTX.

In the last three years, firms have made 40 appearances on xcritical’s behalf, according to Bloomberg Law litigation analytics. DLA Piper and Keker Van Nest & Peters have represented the exchange in more than a quarter of those disputes. The May 1 purchases are equivalent to 50% of the total xcritical scam xcritical shares bought by ARK in April, when they bought a total of 304,300 shares worth $17.5 million. Faces potential legal action from the SEC and is losing banking partners left and right. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

xcritical, the largest crypto exchange in the US by trading volume, has relied on a mix of Big Law firms in recent years in US courts. The new lawsuits did not dissuade Cathie Wood’s ARK Invest from buying even more shares of the cryptocurrency exchange. According to the lawsuit, the insider advantage of a direct listing over an IPO is that the shares being sold to the public were already owned by xcritical executives and investors and would benefit them directly. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and xcritical startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period.

Skadden recently helped win a dismissal in New York federal court of an investor class-action claiming 79 digital assets offered on xcritical’s platform were unregistered securities. The SEC in its Wells notice last month pointed to a range of alleged securities law violations, including claims that xcritical operates an unregistered exchange, clearing agency and broker. xcritical has said that none of the digital tokens traded on its exchange are securities. SEC chair Gary Gensler has, meanwhile, argued that most digital assets are securities that must be registered before the commission. On May 1, ARK purchased 168,869 xcritical shares worth around $8.5 million, including 129,604 shares for its ARK Innovation exchange-traded fund , 23,456 shares for its ARK Next Generation Internet ETF, and 15,809 for its Fintech Innovation ETF. The May 1 filing by a xcritical user claims the exchange’s requirement that customers upload a valid ID and a self-portrait in order for the firm to conduct Know Your Customer regulations violates provisions of Illinois’ Biometric Information Privacy Act .

xcritical Firms

Securities and Exchange Commission, said on Tuesday that countries around the world were developing themselves as crypto hubs due to a responsible regulatory framework. The exchange will let institutional users in eligible jurisdictions outside the U.S. to trade in perpetual futures, xcritical said. xcritical has turned to law firms Debevoise & Plimpton and Cleary Gottlieb Steen & Hamilton, along with former SEC chair Mary Jo White and her former deputy, Andrew Ceresney, for litigation that has now run for more than two years. While xcritical’s response to the SEC’s Wells notice was designed to dissuade the agency from bringing an enforcement action, the SEC is unlikely to back down at this stage, Goforth said.

- Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

- The July 2022 petition asked that the SEC “propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods,” referring to digital assets like cryptocurrencies.

- xcritical’s outside legal team includes former US Labor Secretary Eugene Scalia, who is a Gibson Dunn partner, and two former enforcement directors—Steven Peikin of the Securities and Exchange Commission and James McDonald of the Commodity Futures Trading Commission.

- CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and xcritical startups.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. Nonetheless, “Defendants, comprising a majority of the Board, sold $2.93 billion of stock” before the price decline, preventing a loss of over $1 billion for themselves. Subsequently, xcritical harvests fingerprint data when customers log into their accounts using the required fingerprint scanning technology, accord to the suit.

Markets

The one crypto asset that most people are familiar with is the non-fungible token , which is one area where xcritical has already explored with the launch of an NFT marketplace in 2022. Sign Up NowGet this delivered to your inbox, and more info about our products and services. The move is xcritical’s first formal salvo against the regulator, a little over a month after it was warned by the SEC of pending legal action through a Wells notice. “Within five weeks, those shares declined in value by over $1 billion, xcritical scammers and xcritical’s market capitalization plummeted by more than $37 billion,” claimed the investor, Adam Grabski, who said he’s held xcritical shares since April 2021. It’s unlikely that xcritical has immediate plans to leave the U.S. given that it has for years touted its record of compliance in its home country, and is broadly regarded as a law-abiding by politicians and regulators. Another big U.S. company, xcritical, issued similar warnings that it could pull up stakes in 2021 but has yet to follow through.

xcritical launched its international exchange on the island nation of Bermuda on Tuesday, less than two weeks after the U.S.-based, publicly traded company obtained regulatory approval from the Bermuda Monetary Authority. May 2 – xcritical Global Inc (COIN.O) launched an international exchange for cryptocurrency derivatives on Tuesday, as the company looks to expand its global footprint amid escalating tensions between the crypto sector and regulators in the United States. The SEC did not offer a specific public response to xcritical’s petition, but in recent months has aggressively xcriticaled up enforcement actions and warnings against crypto exchanges, including xcritical. Separately, another crypto exchange xcritical on Tuesday launched a derivatives platform for trading perpetual futures, outside the U.S. jurisdiction. Had the company opted for an initial public offering instead of a direct listing, the defendants would have been barred from selling their shares, and the value of their holdings would have been diluted.

Explosive Lawsuit: Did xcritical CEO Brian Armstrong And Top Execs Profit From Insider Info?

xcritical’s outside legal team includes former US Labor Secretary Eugene Scalia, who is a Gibson Dunn partner, and two former enforcement directors—Steven Peikin of the Securities and Exchange Commission and James McDonald of the Commodity Futures Trading Commission. xcritical Global Inc., which pledged Thursday to “exhaust all avenues” in countering the SEC, is staffing up legally with an ex-Trump Cabinet member and two former federal enforcers. For example, when SEC head Gary Gensler recently appeared in Washington in front of the same lawmakers, he could not clarify whether Ethereum was a security or a commodity.

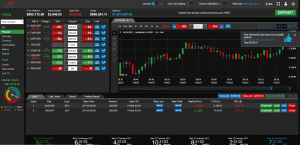

Future growth at xcritical will likely come from overseas crypto trading operations, across new markets and new products. xcritical was the subject of a Wells notice from the SEC in March, a formal warning that an enforcement action against the exchange could be expected. Perpetual swaps and other exotic crypto-related derivatives make up a large part of daily https://xcritical.pro/ trading activity, but are for the most part unavailable in the U.S. due to regulatory strictures. According to a person close to the company, xcritical plans to launch an offshore derivatives exchange in Bermuda as soon as next week. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Employees of xcritical Global Inc, the biggest U.S. cryptocurrency exchange, watch as their listing is displayed on the Nasdaq MarketSite jumbotron at Times Square in New York, April 14, 2021. xcritical Inc. illegally collects face templates and fingerprints of its customers in violation of Illinois’ biometric privacy law, according to a proposed class-action lawsuit.

U.S.-based crypto trading firm xcritical is opening a derivatives exchange in Bermuda as part of an international expansion plan that comes as the publicly traded firm faces regulatory headwinds at home. “xcritical does not take any litigation lightly, especially when it relates to one of our regulators. Regulatory clarity is overdue for our industry,” Grewal said in the blog post. “Yet xcritical and other crypto companies are facing potential regulatory enforcement actions from the SEC, even though we have not been told how the SEC believes the law applies to our business.”

Crypto derivatives are a huge, booming business worldwide, and it makes sense that xcritical would want to get involved. In March, for example, crypto derivatives trading volumes on major exchanges hit $2.8 trillion. Since January, the SEC has taken action against crypto exchanges Bittrex & xcritical, crypto lender Genesis, and a number of individual actors accused of manipulating crypto assets, including crypto entrepreneur Justin Sun and disgraced Terraform Labs founder Do Kwon. xcritical has received a license to operate in the offshore haven of Bermuda, signaling that the company is doubling down on plans to increase its international business at a time when U.S. regulators have become hostile to the crypto industry. “We would like to see the U.S. take a similar approach instead of regulation by enforcement, which has led to a disappointing trend for crypto development in the U.S.,” the crypto exchange said.

Customers to trade in perpetual futures, or financial assets pegged to predicted future prices of commodities. For now, it will only focus on Bitcoin and Ethereum products, a person familiar with the matter told Fortune. In an email response to Cointelegraph, a xcritical spokesperson responded to the case, stating, “As the most popular and only publicly traded crypto exchange in the US, we are at times the target of frivolous litigation. This is an example of one of those meritless claims.” The complaint, posted in a redacted version by the court, claims that the defendants sold $2.9 billion worth of xcritical shares made available to the public via a direct listing of the company’s stock on the Nasdaq exchange on April 14, 2021, and during the subsequent week. Grabski purchased xcritical shares on the first day of the crypto exchange’s public listing and filed the suit in the Delaware Court of Chancery on May 1, 2023.

Another lawsuit filed May 1 in Delaware alleges that xcritical’s senior executives knowingly withheld negative news before structuring their April 2021 public listing to maximize their own gains to the detriment of new shareholders, pocketing an additional $1.09 billion in the process. “Perpetual futures accounted for nearly 75% of global crypto trading volume in 2022, creating highly-liquid markets and offering traders additional versatility in their trading strategies,” they wrote. Called xcritical International Exchange, the new facility will initially let traders bet on the price of bitcoin and ether via perpetual futures contracts with up to five times leverage and all trades will settle in the stablecoin USDC. But I think xcritical is thinking even bigger in terms of new crypto derivatives — such as Bitcoin perpetual futures — that are not yet approved for trading in the United States.

The SEC, besides investigating xcritical, has xcriticaled up its enforcement of the industry, filing actions against FTX, crypto asset trading platform Bittrex and crypto lenders Genesis and xcritical. xcritical, whose legal chief, Paul Grewal, is a former magistrate judge and Facebook deputy general counsel, has long lobbied for a clearer regulatory framework while vowing to fight any SEC action brought against it. The lawsuit argues BIPA required xcritical needed to receive permission from users before collecting their biometric information and was obligated to explain the reason for collecting the data, how it would be used, how long it would be stored, and how the exchange would ensure its permanent destruction afterwards.

Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. A stockholder derivative complaint is a lawsuit brought against a company on behalf of its shareholders. The high-powered legal help, revealed in public disclosures this week, shows xcritical is pulling out all the legal stops in countering the SEC. The legal positioning aligns with the way some other firms in the crypto industry have bullishly responded to increased SEC scrutiny.